Are you a business owner or accountant looking for a reliable financial tool to manage your company’s financial data? QuickBooks may be the answer. QuickBooks offers various features that can help you manage your company’s financial data efficiently. One of these features is the balance sheet. In this article, we will discuss the QuickBooks balance sheet, its importance, and how to work with it in QuickBooks.

What is a QuickBooks Balance Sheet?

QuickBooks balance sheet is a financial report that provides a snapshot of a company’s financial position at a specific point in time. It shows the company’s assets, liabilities, and equity, and is used to calculate financial ratios that provide insights into the company’s financial health. The balance sheet is an important tool for business owners, investors, and lenders to understand a company’s financial position and make informed decisions. QuickBooks provides a customizable balance sheet feature that allows users to organize and analyze their financial data efficiently.

Importance of QuickBooks Balance Sheet

Here are reasons why the balance sheet QuickBooks is an essential tool for managing your company’s finances:

1. Provides a snapshot of your company’s financial position

The QuickBooks balance sheet provides you with an overview of your company’s financial position at a particular point in time. It shows your company’s assets, liabilities, and equity, making it easier for you to see how much your company owns and owes.

2. Helps you track your company’s financial performance

By tracking your company’s financial performance over time, you can identify trends and make informed financial decisions. The balance sheet QuickBooks allows you to compare your company’s financial position over multiple periods, helping you to monitor your company’s financial health.

3. Assists in creating financial reports

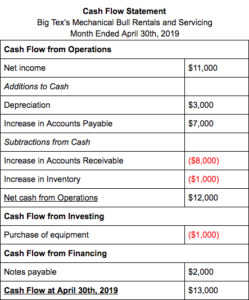

The QuickBooks balance sheet is a tool that can help you create financial reports such as profit and loss statements, cash flow statements, and tax returns. These reports can help you make informed decisions and meet regulatory requirements.

4. Helps you plan for the future

By analyzing your company’s financial position and performance, you can make informed decisions about future investments and growth strategies. The balance sheet in QuickBooks can help you plan for the future by providing you with the information you need to make informed decisions.

5. Assists in obtaining financing

Lenders and investors may require a balance sheet as part of their evaluation process when considering whether to provide financing. By using QuickBooks to create a balance sheet, you can provide potential lenders and investors with the financial information they need to make informed decisions.

6. Helps you manage cash flow

The QuickBooks balance sheet can help you manage your company’s cash flow by providing you with information about your company’s current assets and liabilities. By tracking your cash flow, you can make informed decisions about when to pay bills and when to collect payments.

7. Helps you comply with regulatory requirements

Many regulatory requirements require companies to provide financial statements such as balance sheets. By using QuickBooks to generate a balance sheet, you can ensure that you meet these requirements and avoid penalties.

How to Work with the Balance Sheet in QuickBooks?

Now that we have discussed the importance of the balance sheet in QuickBooks let us take a closer look at how to work with it in QuickBooks.

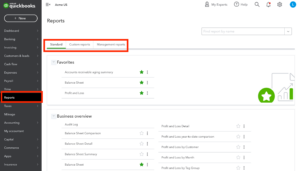

1. Open the balance sheet report

To open the balance sheet report in QuickBooks, select Reports from the left-hand menu and then select Balance Sheet under the Recommended Reports section.

2. Customize the report

You can customize the balance sheet report by changing the date range, selecting the QuickBooks self employed accounts you want to include, and adding filters.

3. Analyze the report

Once you have generated the balance sheet report, you can analyze it to get a better understanding of your company’s financial position. Look at the total assets, liabilities, and equity and see how they compare. Pay attention to any significant changes or trends in your company’s financial position over time. For example, a significant increase in your liabilities may indicate that your company is taking on too much debt.

You can also use the QuickBooks balance sheet to calculate key financial ratios such as the debt-to-equity ratio and the current ratio. These ratios can help you assess your company’s financial health and make informed financial decisions.

4. Update the balance sheet

To keep your QuickBooks balance sheet up to date, you will need to regularly enter and reconcile transactions in QuickBooks. This includes entering new transactions such as invoices, bills, and payments, and reconciling bank and credit card accounts.

It is also essential to keep your chart of accounts up to date. Your chart of accounts is a list of all the accounts you use to track your company’s financial transactions. By keeping your chart of accounts organized and up to date, you can ensure that your balance sheet in QuickBooks accurately reflects your company’s financial position.

Conclusion

The QuickBooks balance sheet is a powerful tool that can help you manage your company’s finances more effectively. It provides a snapshot of your company’s financial position, helps you track your company’s financial performance, and assists in creating financial reports.

By following the steps outlined in this article, you can work with the balance sheet QuickBooks to gain a better understanding of your company’s financial position and make informed financial decisions.

Frequently Asked Questions (FAQs)

Q.1 What is the difference between a balance sheet and an income statement?

A balance sheet shows a company’s financial position at a specific point in time, while an income statement shows the company’s financial performance over a period of time.

Q.2 Can I customize the layout of the QuickBooks balance sheet report?

It is recommended that you update your QuickBooks balance sheet regularly, at least once a month, to ensure that it accurately reflects your company’s financial position.

Q.3 What is the significance of the debt-to-equity ratio?

The debt-to-equity ratio is a financial metric that measures the proportion of debt and equity used to finance a company’s assets. It is significant because it helps investors and lenders understand a company’s financial risk and its ability to pay back debt.